THE PAG-IBIG Fund reported a P1.14 trillion in total assets for the first half of 2025, a P74.90-billion increase compared to the same period in 2024.

The figures were shared during the Pag-IBIG Fund Stakeholders Accomplishment Report held at SMX Convention Center on Wednesday, Aug. 28.

Of the total assets, P869.5 billion are Housing-related; P168.44 billion are incoming generating investments; P83.70 billion are from short-term loans; and P21.16 billion covers other holdings.

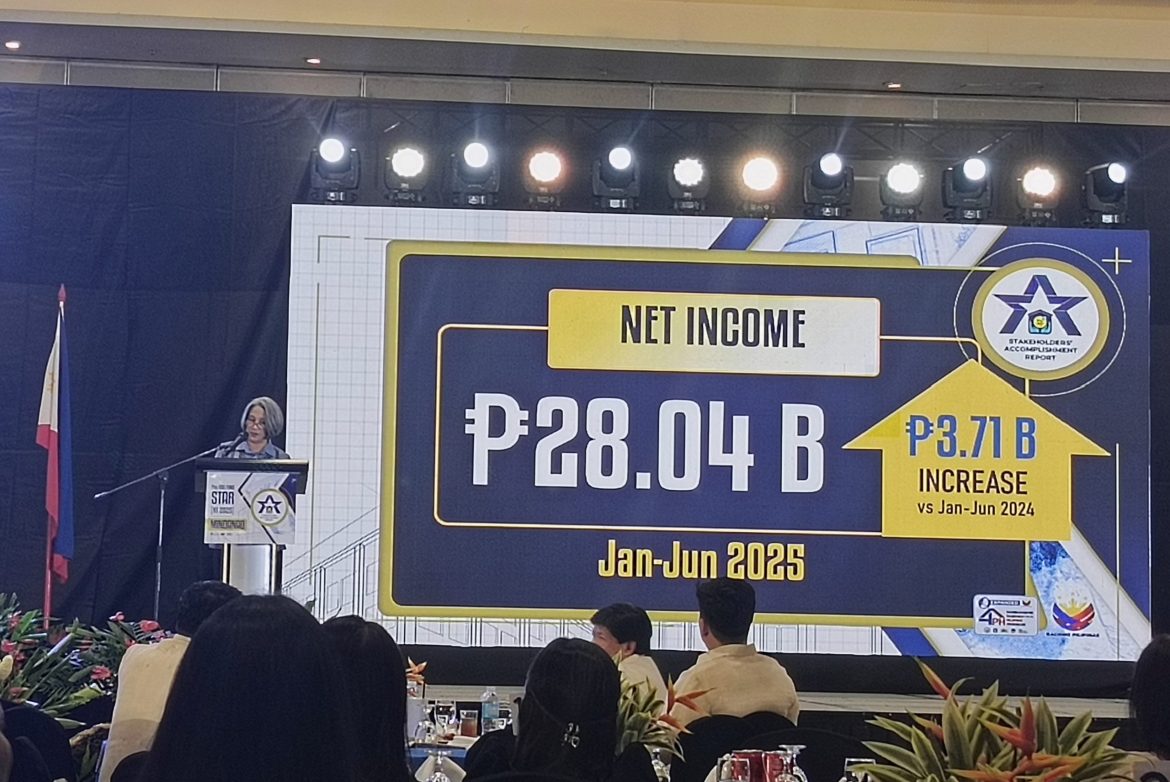

From the gross income of P44.49 billion, the net income was at P28.04 billion, which is an increase of P3.71 billion compared to the same period in 2024.

CEO Marilene Acosta reported that the Pag-IBIG Fund received its 13th consecutive unmodified unqualified opinion from the Commission on Audit since 2012-2024.

Acosta emphasized that the Pag-IBIG continues to perform its twin mandates: to develop provident savings systems and promote home ownership through home financing.

Included in the report are the enhanced short-term loans, which have been reduced from 24 to 12 months to qualify.

Calamity loan programs, on the other hand, allow members to borrow up to 90% of the Pag-IBIG regular savings with 5.95% lowest interest rate in the market.

In terms of housing, the Pag-IBIG continues to offer a special 3% P.A. rate for the first 10 years of lthe oan for the first 30,000 borrowers.

“In our enhanced Expanded Pambansang Pabahay para sa Pilipino Housing ng Pangulong Marcos at DHSUD, qualified Pag-IBIG Fund members can purchase a high-quality house and lot or condominium unit with affordable monthly payments due to the special subsidized rates,” Acosta said.

Benjamin Felix Jr., operations cluster deputy CEO, reported the gains of Pag-IBIG in terms of membership, savings, loan disbursements, and housing initiatives.

Felix reported that Mindanao accounted for a substantial portion of the Pag-IBIG Fund’s active membership and savings in H1 2025.

For active Membership, Mindanao recorded 1.91 million active members, representing 11% of the 16.79 million overall active members nationwide. The national active membership saw a 3% increase compared to H1 2024.

For active membership savings, Mindanao reached ₱7.33 billion, contributing 9% to the ₱80.67 billion overall total. Nationally, active membership savings surged by 25% over H1 2024.

For MP2 Savings, Mindanao generated ₱2.55 billion, making up 6% of the ₱42.68 billion total. The overall MP2 savings experienced a 29% increase compared to H1 2024.

Perez said the increase will be hard to beat, considering it is a huge number.

For loan disbursements and collections, Mindanao played a notable role in the Pag-IBIG Fund’s short-term loan operations.

For short-term loans, the region disbursed ₱6.10 billion in short-term loans, which is 14% of the ₱42.86 billion overall total. Nationally, this amount was up by 21% from H1 2024.

Mindanao’s 226,621 members constituted 14% of the 1,641,814 overall total short-term borrowers, which saw a 10% increase compared to H1 2024.

The short-term loan collections from Mindanao totaled ₱6.21 billion, representing 14% of the ₱43.33 billion total, which rose by 19% against H1 2024.

In the housing sector, Mindanao’s housing loan takeout was recorded at ₱4.50 billion, accounting for 8% of the ₱58.13 billion total. The southern island also delivered 3,004 housing units, or 8% of the 37,927 overall total units nationwide.

For socialized housing, the region contributed ₱116 million (an 8% share) out of the ₱1.49 billion overall total amount, and 280 units (a 10% share) out of 2,809 overall total units.

Mindanao’s acquired assets amounted to ₱606 Million, representing 9% of the ₱6.48 billion overall total, and 564 accounts, which is 8% of the 7,004 overall total accounts.

Felix reported that as of June 2025, Mindanao’s Performing Loans Ratio (PLR) stood at 92.89%, but is slightly below the 94.15% overall national PLR.