THE RIZAL Commercial Banking Corporation (RCBC) continues to sustain strong growth in its credit card business, driven by increased spending among premium clients and a growing base of loyal cardholders who value elevated experiences, convenience, and everyday rewards.

As of the third quarter of 2025, RCBC’s issuing billings have risen by 32 percent year-on-year, while receivables have expanded by 37 percent, reflecting steady consumer confidence and sustained retail activity. The bank now serves over 1.4 million active credit cardholders, marking a 19-percent increase from the same period last year.

“RCBC Credit Cards continue to appeal to discerning customers who expect more from their cards, whether that means access to exclusive dining privileges, worry-free travel, or instant rewards with every purchase. In addition, our cardholders have the ability to manage their credit card accounts at their fingertips with the RCBC Pulz app, which provides 24/7, real-time access to payment management features such as on-demand installment purchase conversion (Unli Installment) and the ability to use the card’s limit to pay sellers who do not accept card payments (UnliPay). Our expanding customer base reflects the strong confidence our clients place in the RCBC brand,” RCBC Credit Cards president and CEO Arniel Vincent B. Ong said.

Cardholders are spending more on experiences this holiday season, with the most notable growth seen in travel, dining, and e-commerce categories. Purchases of electronics and gadgets have also seen an uptick as customers take advantage of year-end sale events and installment offers.

Digital adoption remains a major growth driver. Digital acquisitions have grown by 88 percent year-on-year and usage of card features such as Unli Installment and UnliPay in the RCBC Pulz app remains strong RCBC is also among the first banks to enable Mastercard and Visa credit cards in Google Pay, enabling faster and safer payments for its credit cardholders..

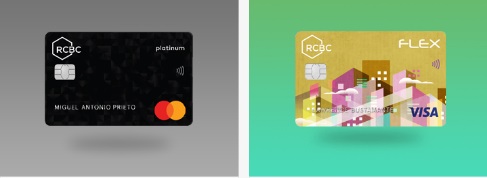

RCBC continues to enhance cardholder experience through meaningful rewards and lifestyle benefits. such as lounge access, free fast food treats, grocery and dining discounts, and cashback rewards for installment purchases. New customers can also avail of the No Annual Fee for Life offer of the bank.

The Yuchengco-led bank’s credit card portfolio remains the largest contributor to its consumer lending business, accounting for 39 percent of total retail loans.

Currently ranked as fifth largest privately-owned bank in the Philippines, RCBC continues to drive innovation through customer-focused, technology-driven solutions that enhance overall customer experience. Through RCBC Credit Cards, the bank remains a partner for its clients’ passion, focused on delivering innovative financial solutions and superior customer experiences. With a comprehensive suite of products tailored to every lifestyle, RCBC Credit Cards offers exclusive perks, travel privileges, and flexible payment options that empower cardholders to live out their passion. RCBC Credit Cards sets industry standards through its commitment to security, convenience, and continuous product innovation. For more information, visit rcbccredit.com or follow RCBC Credit Cards on social media.